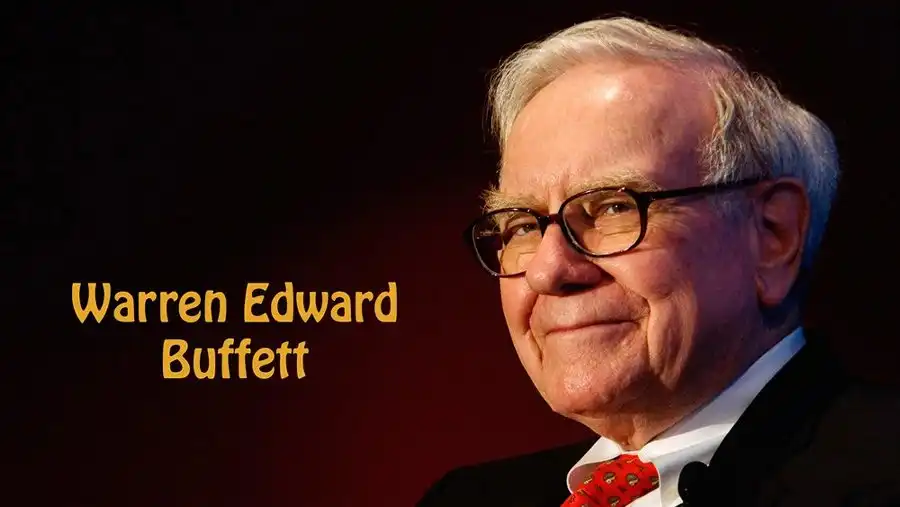

In his early life, he sold chewing gums, Coca-Cola bottles, and weekly magazines too. When he was in high school, he was working at his father’s grocery shop. Along with this job, he also delivered newspapers, sold golf balls and stamps too. Warren Buffett had a business mind from his very childhood. He earned almost 175$ every month by delivering newspapers.

Warren Buffett started with $100 and turned it into a multi-billionaire personality. He proved that it isn’t about the money you have, it’s about the knowledge you have. There are no real barriers to you getting rich if you’re willing to work hard and learn.

Warren Buffett's Thoughts On Life

(1) Past is a waste paper, present is a newspaper and future is a question paper. Come out of your past, control the present, and secure the future.

(2) When something bad happens, you have three choices. You can let it define you, you can let it destroy you, or you can let it strengthen you.

(3) Our eyes are placed in front because it is more important to look ahead than to look back.

(4) We used pencil when we were small but now we use pens. Do you know why? Because mistakes made in childhood can be erased but not now.

(5) Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.

(6) It’s better to hang out with people better than you. Pick out associates whose behavior is better than yours and you’ll drift in that direction.

(7) Of the billionaires I have known, money just brings out the basic traits in them. If they were jerks before they had money, they are simply jerks with a billion dollars.

(8) It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.

(9) If you get to my age in life and nobody thinks well of you, I don’t care how big your bank account is, your life is a disaster.

(10) Be confident. I always knew I was going to be rich. I don’t think I ever doubted it for a minute.

(11) The difference between successful people and really successful people is that really successful people say no to almost everything.

(12) If you don’t find a way to make money while you sleep, you will work until you die.

(13) No matter how great the talent or efforts, some things just take time. You can’t produce a baby in one month by getting nine women pregnant.

(14) You’ve gotta keep control of your time, and you can’t unless you say no. You can’t let people set your agenda in life.

(15) Honesty is a very expensive gift. Don’t expect it from cheap people.

(16) Always know who you’re dealing with. You can’t make a good deal with a bad person.

(17) If past history was all that is needed to play the game of money, the richest people would be librarians.

(18) You only have to do a very few things right in your life so long as you don’t do too many things wrong.

(19) Help tomorrow, act today. Someone’s sitting in the shade today because someone planted a tree a long time ago.

(20) In the world of business, the people who are most successful are those who are doing what they love.

(21) Success is not defined by a price tag or number. I measure success by how many people love me.

(22) If you want to be successful, make reading a habit. I just sit in my office and read all day.

(23) You know… you keep doing the same things and you keep getting the same result over and over again.

(24) Tell me who your heroes are and I’ll tell you who you’ll turn out to be. The best thing I did was to choose the right heroes.

(25) Chains of habit are too light to be felt until they are too heavy to be broken.

(26) You do things when the opportunities come along. I’ve had periods in my life when I’ve had a bundle of ideas come along, and I’ve had long dry spells. If I get an idea next week, I’ll do something. If not, I won’t do a damn thing.

(27) Not doing what we love in the name of greed is very poor management of our lives.

(28) Give to those less fortunate. If you’re in the luckiest 1% of humanity, you owe it to the rest of humanity to think about the other 99%.

(29) The most important investment you can make is in yourself.

(30) I don’t look to jump over 7-foot bars: I look around for 1-foot bars that I can step over.

(31) The most important thing to do if you find yourself in a hole is to stop digging.

(32) Money is not everything. Make sure you earn a lot before speaking such nonsense.

(33) It is not necessary to do extraordinary things to get extraordinary results.

(34) I buy expensive suits. They just look cheap on me.

(35) Bad things aren’t obvious when times are good. Only when the tide goes out to do you discover who’s been swimming naked.

(36) Time is the friend of the wonderful company, the enemy of the mediocre.

(37) The business schools reward difficult complex behavior more than simple behavior, but simple behavior is more effective.

(38) There seems to be some perverse human characteristic that likes to make easy things difficult.

Warren Buffett's Thoughts On Money & Investment

(1) Rule #1 is, never lose money. Rule #2, is never forget Rule #1.

(2) Never depend on single income. Make investment to create a second source.

(3) Don’t save what is left after spending, but spend what is left after saving.

(4) If you buy things you do not need, soon you will have to sell things you need.

(5) Take calculated risks. Never test the depth of the river with both the feet.

(6) Risk comes from not knowing what you are doing. Never invest in a business you cannot understand.

(7) Do not put all the eggs in one basket.

(8) Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.

(9) If you aren’t thinking about owning a stock for 10 years, don’t even think about owning it for 10 minutes.

(10) Our favorite holding period is forever.

(11) Never lose money. Stay rational and stick to your homework when researching businesses in which to invest.

(12) The investor of today does not profit from yesterday’s growth.

(13) In the business world, the rear-view mirror is always clearer than the windshield.

(14) The stock market is designed to transfer money from the active to the patient. Don’t be impatient when it comes to your money.

(15) Why not invest your assets in the companies you really like? As Mae West said, ‘Too much of a good thing can be wonderful.’

(16) You don’t have to be a genius to be a good investor, but there is a lot of hard work and due diligence involved.

(17) Go against the crowd. Be fearful when others are greedy and greedy when others are fearful. Buy when they sell, and sell when they buy.

(18) Diversification is protection against ignorance. It makes little sense if you know what you are doing.

(19) Wide diversification is only required when investors do not understand what they are doing.

(20) I insist on a lot of time being spent, almost every day, to just sit and think. I read and think. So I do more reading and thinking, and make less impulse decisions than most people in business.

(21) Price is what you pay. Value is what you get. Don’t forget business basics. Don’t focus on short-term swings in price; focus on the underlying value of your investment.

(22) It’s far better to buy a wonderful company at a fair price, than a fair company at a wonderful price. If a business does well, the stock eventually follows.

(23) Calling someone who trades actively in the market an investor is like calling someone who repeatedly engages in one-night stands a romantic.

(24) An investor should act as though he had a lifetime decision card with just twenty punches on it. (This is basically saying that you should never buy businesses with the intention of selling them. If you could only buy 10 or 20 stocks in your entire life you’d probably be a lot more careful with where you invest. You’d spend more time looking at the company, and you’d make sure you really love it.)

(25) Buy a stock the way you would buy a house. Understand and like it such that you’d be content to own it in the absence of any market.

(26) You don’t have to be a genius to invest well. You don’t need to be a rocket scientist. Investing is not a game where the guy with the 160 IQ beats the guy with 130 IQ.

(27) The Greatest Enemies of Equity Investor are Expenses and Emotions.

(28) Beware the investment activity that produces applause; the great moves are usually greeted by yawns.

(29) Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.

(30) There are some basic investing rules that you need to learn, and if you follow those rules, you’ll be successful.

(31) Wall Street is the only place that people ride to in a Rolls Royce to get advice from those who take the subway.

(32) If You’re Not Investing You’re Doing it Wrong. Today people who hold cash equivalents feel comfortable. They shouldn’t. They have opted for a terrible long-term asset, one that pays virtually nothing and is certain to depreciate in value.

(33) Smart doesn’t always equal rational. To be a successful investor you must divorce yourself from the fears and greed of the people around you, although it is almost impossible.

(34) Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.

(35) You will see way more stocks that are dramatically overvalued than dramatically undervalued. It’s common for promoters to cause a stock to become valued at 5-10 times its true value, but rare to find a stock trading at 10-20% of its true value.

(36) Watch this pickpocket! A hyperactive stock market is the pickpocket of enterprise.

Warren Buffett's Rules of Success

(1) Find your passion.

(2) Hire Well.

(3) Don’t care what others will think.

(4) Read, Read and Read.

(5) Have a margin of safety.

(6) Have a competitive advantage.

(7) Schedule for your personality.

(8) Always be competing.

(9) Model Success.

(10) Give unconditional love.